Kelly – or Bust

(* see HRG Index announcement at bottom)

The infamous Kelly Criterion – you’ve very likely heard of it, and if you’ve tried using it, are also very likely to be so gun-shy of at this point that you may never want to hear of it again!

It’s got the reputation of being the fastest possible way to build a bankroll – or the fastest possible way to lose one. Like most things that are controversial – the truth of the matter is not with the extremes of opinion, but lies somewhere in between.

If you are interested in a new take on the subject, and in receiving a free spreadsheet I use personally . . .

A super-abbreviated history of Kelly betting –

John Kelly was a colorful research physicist at the laboratories of AT&T Bell in the late 50’s and early 60’s (passing away at the young age of 41 in 1965). Among other of his notable accomplishments – he came up with a theory – “a formula to determine what proportion of wealth to risk in a sequence of positive expected value bets so as to maximize the rate of growth of wealth” (from Wikipedia).

It is known that both billionaires Warren Buffet, and William Gross utilize Kelly’s formula to this day in their public and private funds.

Now – maximizing and managing the growth of multi-billion dollar funds is a different ballgame than betting the ponies – yet the Kelly Criterion applies to any endeavor that attempts to optimize profits. But in horse racing the formula has gotten a bad name. Almost everyone will tell you it is unworkable – dangerous to your bankroll even.

I was first introduced to the Kelly Formula back in the early 70’s by Huey Mahl. Sure enough – I tried it and quickly got onto a ‘reach the moon – or – crash and burn’ roller coaster. Like most others, I dropped it and have only recently come back to re-examine it, and try new approaches with modified versions of the original formula.

For those of you who are relatively unfamiliar with Kelly – you may be asking, “What is the formula?!“

. . . Don’t ask! In the box below is an excerpt – again from Wikipedia – and unless you are a math major, you might want to skip on down the page:

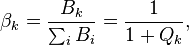

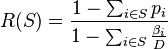

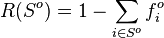

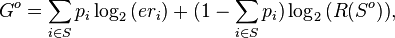

Kelly’s criterion may be generalized on gambling on many mutually exclusive outcomes, like in horse races. Suppose there are several mutually exclusive outcomes. The probability that the k-th horse wins the race is  , the total amount of bets placed on k-th horse is , the total amount of bets placed on k-th horse is  , and , and

where Step 1 Calculate the expected revenue rate for all possible (or only for several of the most promising) outcomes: Step 2 Reorder the outcomes so that the new sequence Step 3 Set Step 4 Repeat: If Else set If the optimal set One may prove that where the right hand-side is the reserve rate. Therefore the requirement and the doubling time is This method of selection of optimal bets may be applied also when probabilities |

Huh?!

The ‘basic’ formula is much simpler than that – and essentially (in layman’s terms) the formula says that for optimizing growth/profits – a bettor should always wager his advantage. If you have a 25% advantage in your next bet – then you should wager 25% of your total bankroll.

– Enter the initial problem with Kelly betting: It is entirely impossible to know your exact advantage in the next race. As has been said – so many times it should be etched in every handicapper’s brain – “Anything can happen in a horse race!“

– And yes – you’ve already identified the next obvious problem (which is really a corollary of the first problem) – “What? – wager 25% of my bankroll on a single race – are you nuts!“

– And the third bug in the ointment: the Kelly Criterion assumes an infinite series of wagers – and obviously we don’t have infinity at our disposal!

So again – it is difficult to use Kelly betting with horse racing (less so with a more-or-less “fixed advantage” game like blackjack for a sharp card-counter). Most of the astute professional bettors out there will tell you that when you hear someone espousing the benefits of Kelly Betting – that for the safety of your bankroll, you should- “Run away – run as fast as you can!“

But . . .

There is one interesting fact about the Kelly Formula: A “full” Kelly bettor has a 1-in-3 chance of halving his bankroll before doubling it. And with a wager of exactly half your expected advantage, a “half” Kelly bettor has a 1-in-9 chance of halving his bankroll before doubling it.

Now – given how incredibly fast Kelly betting can pump up bottom-line profits (and wanting to take advantage of this), and using the above ‘halving/doubling’ projections – a player needs to start a Kelly campaign with multiple bankrolls in order to survive the 1-in-3 or 1-in-9 (or whatever – according to the % you are using) times he will go bust.

That is – if you have, say $1000 to start – you should consider breaking that into 4 starting “Kelly” banks of $250 each (or 5 banks of $200). So – you are willing to “go bust” every now and then – because you are risking only a quarter (or a fifth) of your actual working bankroll. This allows you to be in front of those good streaks when Kelly will literally “take you to the moon.”

How then do you handle the other problem of initially figuring your advantage, so you know what % of your bankroll to bet each time?

Unfortunately for most (but fortunately for those who take the game seriously) – this requires good record-keeping over a long series of actual wagers.

This record-keeping will enlighten you as to which kinds of races you do well at – and which not . . . at which tracks you do well – and which not – etc. You then narrow your game down – hone it – optimize it – gain in precision and patience.

When you have this data, you can then find your correct long-term advantage over the game, and assume this will be your ‘average’ advantage in the next race. This is untrue of course: As discussed in a recent post, the advantage over the next race is always zero.

But it is only the long term in which we are interested. Using Kelly – the short term streaks will cause your ‘active’ bankroll (as opposed to your working bankroll/back-up bankrolls) to fluctuate wildly.

Here we address the third problem with Kelly. We are not playing this game for an infinity – so: A solid profit-taking plan becomes essential. When the bankroll explodes with Kelly betting – you must take down profits. You cannot just “let it ride” because it will crash – and usually sooner than later.

——————————

I’ll stop here for now – maybe revisit the concept in a later post. If you would like a copy of the Excel spreadsheet I use to find out my exact best percentage-of-bankroll to wager in each race, post a comment below. Let me know what you think and request the spreadsheet – I’ll send it right out to you.

A few last words here . . .

– Your ROI betting Kelly won’t usually vary much from flat-betting, but your profits (or losses) will.

– Like in flat-betting, the order of wins and losses don’t affect the ROI.

– But – you must have some kind of advantage. Over the long term, Kelly won’t turn a losing series into a winning one.

A profit-taking plan to consider:

– When your initial active BR doubles (in the $1000/$250 example above – when you hit $500 in your active bank) – take out 25% of the profits only. Example: say that after hitting a winning wager, your active Bankroll stands at $532. Take 25% of $282 ($532-$250) = $70 – Leaving you a “new” total active Bank of $462.

But – you still start your next active Bankroll at $250 and use your optimal percentage (or portion of same) to figure your wagers on that. I.e – say your optimal percentage of bankroll (your advantage over the game) is 18% – you will decide to use 18% or some portion less than that. Say you’ve decided on 3/4 ‘Kelly’ – your first new wager in the second leg of your campaign would be 13.5% x $250 = $34.

– On the next doubling of your “active” betting bankroll – take 50% of profit only (your active ‘betting’ bank is still $250 remember – not the total active including residual profit of $462). Do this no matter when it occurs – even if in the middle of the racing day – stop and re-figure) –

– On the next doubling – take 75%

– On the 4th doubling – take 100% of profits on that 4th leg (doubling) of series.

– Now – from all taken-down profits of the campaign starts you’ve had in order to reach this 4th doubling (and you’ll very likely have burnt through a starting BR or two along the way) – add $250 back-up BR/s from the accrued ‘take-down’ profits to your back-up banks to get back to 4 (1 active / 3 back-up), and look at the remaining amount as true profit.

Give that to your wife!

Okay, okay – you can also put it in the bank, or spend it on golf clubs, or the mortgage – food – whatever – that’s okay too! 🙂

If/when you arrive at that 4th doubling – consider raising your starting BR level. You’d simply divide what remains by 4 and start a new campaign.

Anyway . . . as always – food for thought. Let me know what you think. – Gary

p.s. You might want to apply these ideas to the HRG Index.

* We will be starting the Index back up on Thursday, August 13th. There will be a new simplified format – three horses only in the Index – with guidelines on who to wager. We will issue the Index the morning of the races – by 9:30 a.m. Eastern Time – then we will update approx 10 min. before each race (and post to the subscriber-access-only page). In this way we can better adjust the Index for reasons of scratches and resultant changes in the pace scenario, weather, odds – etc.

The HRG Index will be issued Thurs through Sunday.

are the pay-off odds.

are the pay-off odds.  , is the dividend rate where

, is the dividend rate where  is the track take or tax,

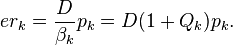

is the track take or tax,  is the revenue rate after deduction of the track take when k-th horse wins. The fraction of the bettor’s funds to bet on k-th horse is

is the revenue rate after deduction of the track take when k-th horse wins. The fraction of the bettor’s funds to bet on k-th horse is  . Kelly’s criterion for gambling with multiple mutually exclusive outcomes gives an algorithm for finding the optimal set

. Kelly’s criterion for gambling with multiple mutually exclusive outcomes gives an algorithm for finding the optimal set  of outcomes on which it is reasonable to bet and it gives explicit formula for finding the optimal fractions

of outcomes on which it is reasonable to bet and it gives explicit formula for finding the optimal fractions  of bettor’s wealth to be bet on the outcomes included in the optimal set

of bettor’s wealth to be bet on the outcomes included in the optimal set

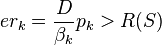

is non-increasing. Thus

is non-increasing. Thus  will be the best bet.

will be the best bet. (the empty set),

(the empty set),  ,

,  . Thus the best bet

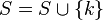

. Thus the best bet  will be considered first.

will be considered first. then insert k-th outcome into the set:

then insert k-th outcome into the set:  , recalculate

, recalculate  according to the formula:

according to the formula:  and then set

and then set  ,

, and then stop the repetition.

and then stop the repetition. .

.

and

and  .

.

Could you please send me a copy of the spreadsheet. Thank you.

John – Done – Gary

Gary, can you send me a copy of the Kelly spreadsheet?

Thank you in advance.

Jim

Spreadsheet please…..

Spreadsheet please thx Vito

Vito – Sent – Gary

would love a copy of the spreadsheet

Bradley – It’s on its way. Check your email box. Best regards – Gary

Hi,

Is your spreadsheet for several bets in the same race?

If so, does it insure that , given that the winner is one of the bet horses, you are sure to be beneficial in this race?

Anyway , I would enjoy to use it.

Regards,

sandoz

Gary – I had a lot of math courses during my studies as an Aerospace Engineer, but the Kelly math looks pretty complicated. I understood what you explained so it makes sense. Add me to your list interested in your spreadsheet. Thanks – Joe

Thank you very much for the info and I wouls like to recieve the

spreadsheet

Mike – Sure thing. On the way via PDF in an eamil. Best regards – Gary

Hi Gary,

Kelly always fascinated me. Please send the spreadsheet. Thanks.

Rams

Could you please send me a copy of the spreadsheet.

Thank you

G’day Gary, for years I’ve been breaking even, or just above or just below even, mainly because I’m probably too cautious.

Keep reading about Kelly but always thought it too complicated for me, but now I’d like to have a go with your spreadsheet.

Thanks,……..Peter M

Could I please have a copy of the spreadsheet.

Thank you,

John

I would like to see the spreadsheet

Wow. Just wow.

I would be interested in checking this spreadsheet out as well.

Hi Gary,

I am interested in looking at your Kelly plan. Please send me your spreadsheet.

I also studied Kelly many many years ago.

What I have found to be most profitable is playing against other handicappers at DerbyWars where the take is around 10%. Rather than trying to be the track take of 18% to 25% or more, I am going head-to-head with other handicappers. I’ve gone from about a -12% ROI to well over 100%.

I’d like take another look at Kelly, but I doubt I can apply it at DerbyWars…. but it’s worth a look.

Thanks for sharing.

Roger S

I agree that trying to use this system is not the ideal way to wager. There are too many other systems that may give one a better and safer edge.

Out or curiosity, please send me the spread sheet for my review. Thanks

Hello Gary,

Thanks for this article. My problem is I’m a good handicapper but poor money manager. Please send me your spreadsheet maybe it will help.

Thanks for the article,

Gail

I’d like to give this Kelly spreadsheet a whirl. Much of what I have been using recently belongs in the garbage. Thanks!

Gary,

Since I am mostly an exotics bettor I would like to see if I can maximize my profits if I used some sort of Kelly Criterion betting system. Thanks.

Phillip

Hi Gary,

I live in Australia and we are coming into our spring racing period. I enjoy handicapping and would love to give your spread sheet a go.

Cheers

Trev

Gary,

You have once more piqued my interest. Your spreadsheets have always provided insight and I would expect nothing less from this one. Please send it my way.

Thanks,

Bill

GARY

As always a great job,Clean and to the point.Would also like a copy of spreadsheet.

Thanks

TERRY

Gary,

Have done some reading on Kelly before, would love to see your spreadsheet.

Thanks, Pete

Hi, Gary,

Another interesting and informative article . . . Thank you for the insight that you provide in your blogs. I, too, would like to request a copy of the spreadsheet. Thanks.

All the best.

Hi Gary,

No Einstein here, but kelly spreadsheet sounds interesting enough. Would like to have a copy of the spreadsheet. Thanks much Gary. Always appreciate what you do for us poor horse racing souls. Take care!

Len

Thanks Len – spreadsheet on its way . . . – Gary

All –

For those of you requesting the spreadsheet and contemplating using the Kelly approach to betting:

You need to be careful.

You need to re-read the profit-taking plan I gave and use it, or even a more aggressive version of it – i.e. with high % of BR betting – you need to get the rapidly escalating profits accrued during a win streak – out! You need to take profits down before the tide turns, and your high % wagers suck all those profits away from you.

Finding the best % of BR for maximal growth of that BR – doesn’t mean that you will be using that % – re-read the bottom part of the text box in the spreadsheet.

Don’t hesitate to break your initial BR into 5 or 6 “active BR’s – you want to lose as little as possible when you burn through one of those. – Gary

As a serious handicapper since 1982, I have long ago learned to dismiss 99% of what other handicappers say or think. However, I spent the entire 4th of July weekend reading every single word of your blog going back several years. Hardly a waste of my 4th of July, as I avoided all the drunks with explosives, while enjoying some fine reading. You impart a tremendous amount of “free” wisdom in your blog Gary, a testament to you as a person. I have not found optimum “Kelly” useful for betting purposes but I would love to see your spread sheet, perhaps I will be enlightened.

Tom – Thanks for the kind words. See my comment (probably immediately below yours). If there is a “secret” to using Kelly – or any high % of BR approach – it is in looking to take maximal advantage of the positive streaks in the betting cycles. It requires a certain ‘nimbleness’ and the ability to “get out while the gettin’ is good.”

Also – we have been trained into thinking of our “Bankroll” as one entity, and of course if thought of like that – the last thing in the world a player would want to do is risk the totality of that ‘one’ BR. So again – if a player chooses to work with the Kelly approach, I believe he should only risk small (in relation to the whole) “active” bankroll segments – and he needs to be able to lose those without going on tilt – i.e. the ruin of one active BR segment should not be devastating to the overall health of the total BR. And he needs the fortitude to step back in immediately with a new segment in order to still be in position to capture the lucrative results of any short-term win streak. – Gary

Does “advantage” equate to win percentage?

John – No. Say a player bets on nothing but horses at 4/5 and less – his win % will be very high, but he may have no advantage over the game – i.e. he may be in the red with his bottom-line profit/loss figures. The Kelly formula in fact shows that advantage, but for an easier understanding, your “Advantage” equates more or less with your long-term ROI. If you have net profits of 11% over a sufficient number of races to make it valid – then your advantage is approx 11%. – Gary

Wow-that was a lot of math! yes I am interested in the spread sheet–I have been looking for a good money management method-this seems to fit the bill. Thanks!

please send me a copy of the spreadsheet like to see it thx Vito

Interesting article. I too have tried and left the Kelly system I would be interested in your spreadsheet. I didn’t see a link though.

Thanks for the HRG update.

As always you come up with great solutions to complex issues. I would appreciate a copy of the spreadsheet very much.

Thank you for great material!

Like more info on Kelly criterion

I love to have the spreadsheet

Thanks

Hi Gary

I would like a copy of the Excel spreadsheet that you use to find out my exact best percentage-of-bankroll to wager in each race, as always thanks for your great work!!

Best Regards

Paul R

Gary,

A few years ago, I heard about someone using a “Quarter-Kelly”

for Sports Betting and decided to emulate the above approach.

I found it relatively easy to calculate my wagers and made a

modest profit. I even think that a “Half-Kelly” is relatively safe,

as long as you can verify your advantage.

Please send me the Spreadsheet and thank you!

Michael